Who is eligible for Critical Illness Insurance and what is the Maximum Critical Illness Benefit. Understanding Critical Illness Insurance No one plans for a critical illness but having essential supplemental insurance coverage during a major medical event can bring peace of mind and financial support when it is needed most.

Is Critical Illness Insurance A Necessary Precaution

Ad Get 250000 in Coverage for as Low as 10 per Month.

. Spouse Critical Illness Rider This rider provides coverage for the policyholders spouse if they are diagnosed with a critical illness. Apply For Next Day Coverage With a Golden Rule Ins Co Short Term Medical Insurance Plan. And the cash benefits can be.

Whats covered by Critical Illness Insurance. Depending on the plan you choose you may be able to receive coverage for first-time events and second-time occurrences of the same critical illness. Did you have critical illness insurance with Sun Life through your employer and your workplace coverage is ending.

Benefit Amount Guaranteed Issue Amount Employee 5000 10000 15000 Up to 15000 Spouse 50 of employee amount Up to 7500 Children 25 of employee amount All guaranteed issue See Guaranteed Issue section below for more information. Our underwriters will review your medical history to determine if youre approved for a plan. Critical Illness Insurance can help by paying cash benefits for a covered diagnosis in addition to any other insurance already in place.

Ad Life Insurance You Can Afford. No Medical Exam - Simple Application. If youre diagnosed with a covered illness like cancer stroke heart attack or other.

Within the State of New York only ReliaStar. Youall active employees working 30 hours per week. As Low As 349 Mo.

We Watch Claim Trends to Create Stop Loss Solutions Employers Brokers and TPAs Can Trust. Covered illnessesconditions are broken out into groups called modules Below are the modules available but depend on your employers plan offering. And it certainly doesnt help pay personal expenses that may accrue during recovery.

Enrollment for employees spouses and children. This type of plan supplements existing health. Mary is sidelined from work for several months while she focuses on recovery.

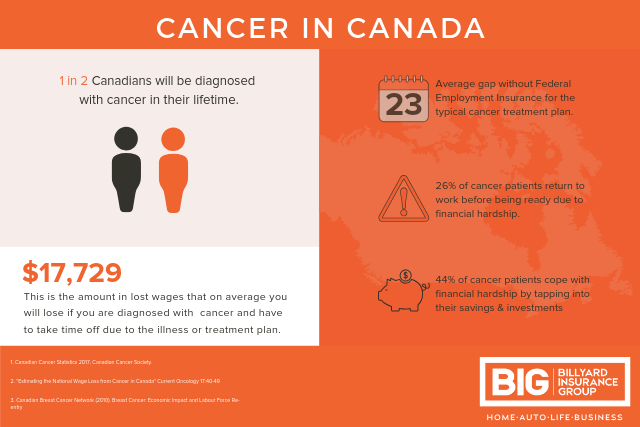

When a serious illness strikes your finances can be endangered along with your health. Critical Illness Insurance is available to members age 65 and over only when renewing coverage. A lump sum benefit payment to use as you see fit Dependent coverage for a spouse or partner and children 2 No obligation to submit expense receipts Portable coverage options should you.

Ad Helping to Protect Self-Funded Employers From the Financial Risk of Catastrophic Claims. Aflacs critical illness insurance may also help cover dependent children under the age of 26 and spouses if applicable. This provides protection and security for all family members who suffer a covered critical.

Critical Illness Insurance is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act. This brochure contains a brief description of the benefits provided by the group critical illness insurance policy issued to Emergency Medical Alliance EMA by Liberty Insurance Underwriters Inc. Your premium amount will be determined by the amount of insurance coverage you request your age tobacco classification and what type of policy you request.

Critical Illness Insurance can help you weather a crisis without draining your savings. Get a Free Quote. O You may purchase a 10000 20000 or 30000 Maximum Critical Illness Benefit.

Even if you have health insurance the out-of-pocket costs of treatment hospitalization and missing work can add up fast. Critical Illness Insurance gives employees a lump sum cash benefit they can use to pay bills such as deductibles coinsurance mortgage payments and groceries if they face an unforeseen illness. See your Certificate of Insurance for more information.

Several months later Mary had a heart attack while mowing the backyard. Critical illness insurance provides you with a lump sum of money if you are diagnosed with certain illnesses or disabilities. Critical Illness Insurance is a limited benefit policy.

At the same time the average annual deductible for an individual has also climbed up 49 percent over the last five years from nearly 1000 in. Spouses are eligible to buy insurance without requiring member to be insured. This advice applies to England.

If your spouse is also a physician you may not apply for more than 250000 as a physician or spouse on each others application. Critical illness insurance is the plan that protects you in the event of a future major illness diagnosis. Benefits are payable at 100 of the.

If spouse coverage the date your spouse attains age 70. Critical Illness Insurance through your employer may offer benefits for. The kinds of illnesses that are covered are usually long-term and very serious conditions such as a heart attack or stroke loss of arms or legs or diseases like cancer multiple.

2 Critical Illness insurance is only available to members under age 65. Ad Shop Short Term Medical Health Plans with Golden Rule Insurance Co. The most common conditions we pay claims for include.

Covered Critical Illnesses and Events Benefit Amount. Get a Free Quote Now. Core health insurance doesnt always cover all the costs associated with a critical illness diagnosis and treatment.

If so you can convert it for yourself your spouse and children. Critical illness insurance claim example Mary is a full-time Pima County employee who enrolled her spouse and children in critical illness insurance during open enrollment. No Medical Exam - Simple Application.

It is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act. Call 888 987-9594 or visit get a quote to learn what plan you may be eligible for. Insurance products are issued by ReliaStar Life Insurance Company Minneapolis MN and ReliaStar Life Insurance Company of New York Woodbury NY.

Coverage is available only if employee coverage is elected. Your spouse 50 of the employee election Your children 7500 or 15000 Children up to age 26. Helpful tips Medicine is advancing to help illnesses like cancer heart attack and strokes but medical bills follow long after the patients recovery.

Your spouse under age 70. Critical Illness Insurance provides benefits for the covered medical conditions and diagnoses shown below. Keep up to 100000 of coverage for each you and your spouse and 20000 for each eligible child.

The date your dependent has received the maximum benefits under the Policy.

How To Sell More Critical Illness Insurance Life Design Analysis

Critical Illness Insurance The Complete Guide Best Companies

/aflac-9c9e2d393e9a40dc9269017c0ca7a1df.png)

The 7 Best Critical Illness Insurance Companies Of 2022

Critical Illness Insurance What Is It Do I Need It Breeze

About Critical Illness Health Insurance Plan Comparepolicy Com

What Is Critical Illness Insurance Coverage Payout And More

Critical Illness Insurance The Hartford

How Much Critical Illness Insurance Do I Need Factors

What Is Critical Illness Insurance Should I Buy It

Blog Title What Is Critical Illness Insurance

Critical Illness Insurance Critical Illness Policy Cover Care Health Insurance

What Is Critical Illness Insurance Critical Illness Critical Illness Insurance Ill

Star Health Critical Illness Insurance Plans In India

Tidak ada komentar:

Posting Komentar